Weekly highlights

Ocean rates – Freightos Baltic Index

Asia-US West Coast prices (FBX01 Weekly) decreased 10% to $2,418/FEU.

Asia-US East Coast prices (FBX03 Weekly) decreased 2% to $3,859/FEU.

Asia-N. Europe prices (FBX11 Weekly) decreased 5% to $2,779/FEU.

Asia-Mediterranean prices(FBX13 Weekly) decreased 5% to $4,179/FEU.

Air rates – Freightos Air Index

China – N. America weekly prices increased 8% to $6.74/kg.

China – N. Europe weekly prices decreased 4% to $3.44/kg.

N. Europe – N. America weekly prices increased 10% to $2.53/kg.

Analysis

Winter weather is complicating logistics on both sides of the Atlantic. Affected areas in the US, especially the southeast and southern midwest are still recovering from last week’s major storm and cold.

Storms in the North Atlantic slowed vessel traffic and disrupted or shutdown operations at several container ports across Western Europe and into the Mediterranean late last week. Transits resumed and West Med ports restarted operations earlier this week, but the disruptions have already caused significant delays, and weather is expected to worsen again mid-week.

Join 65,000+ Supply Chain Experts Who Never Miss an Issue!

Start your week with the industry insights others miss.

« * » indicates required fields

Consent*

The resulting delays and disruptions could increase congestion levels at N. Europe ports, but ocean rates from Asia to both N. Europe and the Mediterranean nonetheless dipped 5% last week as the pre-Lunar New Year rush comes to an end. Daily rates this week are sliding further with prices to N. Europe now down to about $2,600/FEU and $3,800/FEU to the Mediterranean – from respective highs of $3,000/FEU and $4,900/FEU in January.

Transpacific rates likewise slipped last week as LNY nears, with West Coast prices easing 10% to about $2,400/FEU and East Coast rates down 5% to $3,850/FEU. West Coast daily prices have continued to slide so far this week, with rates dropping to almost $1,900/FEU as of Monday, a level last seen in mid-December.

Prices across these lanes are significantly lower than this time last year due partly to fleet growth. ONE identified overcapacity as one driver of Q3 losses last year, with lower volumes due to trade war frontloading the other culprit.

And trade war uncertainty has persisted into 2026.

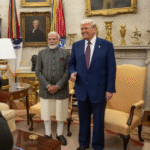

India – US container volumes have slumped since August when the US introduced 50% tariffs on many Indian exports. Just this week though, the US and India announced a breakthrough in negotiations that will lower tariffs to 18% in exchange for a reduction in India’s Russian oil purchases among other commitments. President Trump has yet to sign an executive order lowering tariffs, and the sides have not released details of the agreement, but once implemented, container demand is expected to rebound on this lane.

Recent steps in the other direction include Trump issuing an executive order that enables the US to impose tariffs on countries that sell oil to Cuba, and threatening tariffs and other punitive steps targeting Canada’s aviation manufacturing.

The recent volatility of and increasing barriers to trade with the US since Trump took office last year are major drivers of the warmer relations and increased and diversified trade developing between other major economies. The EU signed a major free trade agreement with India last week just after finalizing a deal with a group of South American countries, and other countries like the UK are exploring improved ties with China as well.

In a final recent geopolitical development, Panama’s Supreme Court nullified Hutchinson Port rights to operate its terminals at either end of the Panama Canal. The Hong Kong company was in stalled negotiations to sell those ports following Trump’s objection to a China-related presence in the canal. Maersk’s APMTP was appointed to take over operations in the interim.

In air cargo, pre-LNY demand may be one factor in China-US rates continuing to rebound to $6.74/kg last week from about $5.50/kg in early January. Post the new year slump, South East Asia – US prices are climbing as well, up to almost $5.00/kg last week from $4.00/kg just a few weeks ago.

China – Europe rates dipped 4% to $3.44/kg last week, with SEA – Europe prices up 7% to more than $3.20/kg, and transatlantic rates up 10% to more than $2.50/kg, a level 25% higher than early this year.